Uncovered: India’s Financial institution of Baroda misused buyer information to flog app | Enterprise and Economic system Information

[ad_1]

A Financial institution of Baroda officer from Bhopal zone recollects the day he and his colleagues received the order from their regional workplace to report back to work at 7am on March 24 final yr.

They got a job: enroll clients for the financial institution’s new app, “bob World”, which was launched six months earlier than. The officer’s department was given a goal of onboarding at the least 150 current financial institution clients.

Because the day progressed, the officer and his colleagues struggled to get folks to enroll whereas their regional workplace saved tabs on them and reprimanded them for poor efficiency.

The officer, who requested that his identification not be revealed for worry of reprisal from the financial institution and who will probably be known as Whistleblower 1, received determined.

He and his colleagues discovered of a workaround from friends in different branches: fetch the record of financial institution accounts not linked to cell numbers, hyperlink these accounts to any cell numbers they might collect – of financial institution staffers, sanitation and safety staff and their family members – to generate the one-time password (OTP) wanted to hitch the app, and enroll these accounts from the again finish. The workers would then deregister these clients from the app and reuse the identical cell quantity in the identical method with different financial institution accounts.

When the nodal officer from the regional workplace – one officer was deputed at every department to make sure the success of the duty – was advised in regards to the tactic, he supplied his in addition to his spouse’s cell numbers to hyperlink with clients’ financial institution accounts.

Despite the fact that such meddling with clients’ accounts is illegitimate and unethical, the group applied this technique and saved at it until late at night time.

Financial institution of Baroda staff from different states – Uttar Pradesh, Rajasthan, Gujarat and Jharkhand – additionally confirmed this broadly prevalent modus operandi to Al Jazeera. A retired govt from Gujarat has despatched 5 emails to the financial institution’s prime administration highlighting these irregularities. He shared these emails with Al Jazeera on the situation of anonymity.

The e-mail he despatched in February final yr, after his retirement, reads: “Activation of bob World is given a lot stress that nearly a fraud-like state of affairs is arising and within the accounts of consumers, cell variety of department head is up to date for activation … A really large fraud is within the offing.”

The financial institution’s buyer care division replied to this e-mail, insisting that one cell quantity might be linked with just one bob World account.

In certainly one of his subsequent emails – despatched between March and June of final yr to the managing director and chief govt officer in addition to govt administrators – the retired govt wrote that he visited just a few branches in his metropolis and advised that he discovered that the workers at these branches weren’t solely including their very own cell numbers to clients’ accounts but in addition shopping for new SIM playing cards to inflate the variety of registrations of bob World. One among his emails says that inside inspection studies of some branches have even made a be aware of those shenanigans.

Ashish Mishra, common secretary of We Bankers Affiliation, a commerce union of financial institution staff, advised The Reporters’ Collective their union had obtained many complaints in regards to the March 24 “Maha Login Day” – together with of staff who had been reprimanded for talking up about strategies that had been being pushed to spice up app registration. We Bankers had shared screenshots of some of those complaints on Twitter.

Despite the fact that many purchasers had been deregistered proper after they had been signed up – that means utilizing these practices to signal them up didn’t routinely result in a rise within the variety of lively customers of the app – it did enhance the variety of downloads and the variety of sign-ups. These metrics are additionally cited to gauge an app’s success.

Inform-all emails

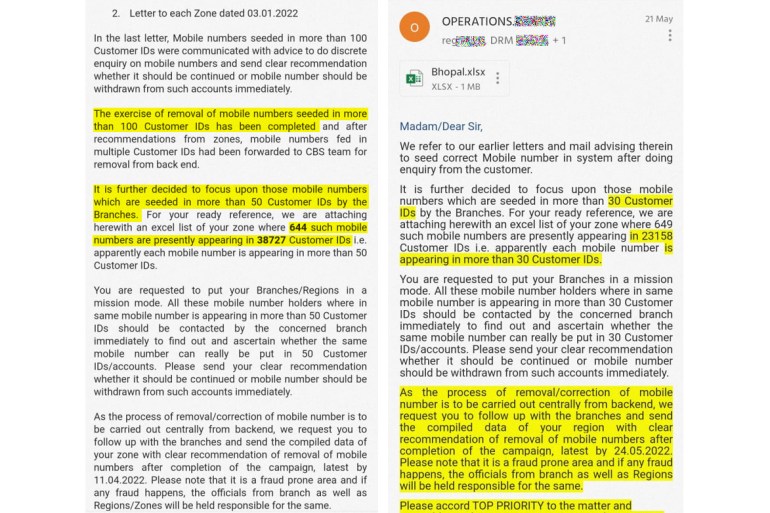

Inside emails of Financial institution of Baroda, India’s second-largest government-owned financial institution, acknowledge that the security of tens of hundreds of financial institution accounts was in danger since they had been linked with strangers’ cell numbers. Whistleblower 1 supplied Al Jazeera screenshots of the emails despatched by the operations division of his regional workplace within the Bhopal zone to the branches underneath it.

The emails, which had been first despatched in January 2022, present that branches had been requested to conduct a discreet inquiry about cell numbers linked to a number of accounts and, in gentle of these inquiries, to suggest whether or not the cell numbers needs to be withdrawn. The cleanup was to happen in phases. First, the telephone numbers that had been illegally linked to a most variety of accounts – 100 or extra – needed to be de-linked. This was adopted by cell numbers linked with 50-plus accounts and later these with 30 or extra accounts.

The emails present that within the Bhopal zone, near 1,300 cell numbers had been tied to wherever from 30 to 100 financial institution accounts, placing practically 62,000 financial institution accounts in danger. That’s on common 47 financial institution accounts linked to a single cell quantity. The financial institution’s coverage states that one cell quantity can’t be linked with greater than eight accounts, and provided that all these accounts are of the identical household.

The precise variety of financial institution accounts mapped with strangers’ cell numbers can be a lot increased if the small print had been accessible for telephone numbers linked with 100 or extra accounts, too.

As a lot was indicated in an e-mail shared by Whistleblower 1 from his regional workplace to all of the department workplaces underneath it: “Within the final letter, cell numbers seeded in additional than 100 Buyer IDs had been communicated with recommendation to do [a] discreet inquiry on cell numbers and ship clear suggestion whether or not it needs to be continued or [if the] cell quantity needs to be withdrawn from such accounts instantly.”

One other e-mail from the identical workplace admits the chance of fraud: “It’s a fraud-prone space, and if any fraud occurs, the officers from the department, in addition to areas, will probably be held accountable.”

Al Jazeera acquired screenshots of the spreadsheet connected to this e-mail containing the small print of cell numbers linked with 30-50 financial institution accounts.

Whistleblower 2, whose identify has additionally been withheld to guard him from retaliation from the financial institution, works in a regional workplace of the Financial institution of Baroda in one other state. He executed such a cleanup drive final yr and advised Al Jazeera that a lot of the duplicate numbers turned out to belong to financial institution workers. Al Jazeera has a replica of the letter whereby Whistleblower 2’s workplace advisable to its zonal workplace that these numbers be unlinked.

Whilst increased workplaces had been eradicating bogus cell numbers, branches had been allegedly including bogus numbers in bulk to satisfy their bob World targets.

Whistleblower 1 stated the bob World fraud is the main motive why an inordinate variety of financial institution accounts get linked with the workers’s cell numbers.

Whistleblower 2 gave another reason: When an individual who doesn’t personal a cell phone opens a checking account, the financial institution worker enters their very own or the department’s official cell quantity because the buyer’s quantity as among the officers insisted on having one on the file.

Whistleblower 2 stated this follow is an open secret and got here in helpful in the course of the bob World enrolment marketing campaign final yr. He was one of many folks deputed to a department as a nodal officer for the marketing campaign, and his zonal workplace requested nodal officers that each one such accounts be signed up on the app utilizing the cell phone numbers of the workers.

Many accounts are having financial institution department cell quantity and attributable to this department staffs are capable of onboard them to #BOBWorld and the purchasers are completely unaware.

Such record of A number of Buyer id with similar cell numbers are being forwarded to them from Zonal workplaces— Chandan Kumar Singh (@_ChandanKSingh) March 25, 2022

It isn’t clear what triggered the cleanup train.

Accounts compromised

Linking unauthorised cell numbers exposes clients to the chance of fraud because the individual with the registered cell quantity good points entry to the account and can change online banking passwords, pay money for new ATM playing cards, wipe clean financial institution accounts and way more. Briefly, they’ll change into account holders within the digital world. A Financial institution of Baroda buyer from Uttar Pradesh lost 1.5 million rupees ($18,150) in 2021 as his registered cell quantity lapsed and received reassigned to another person, who exploited the cell banking entry to the hilt.

Forensic accountant and Licensed Fraud Examiner Nikhil Parulkar, co-founder of forensic advisory companies agency Ocurisc Consulting, stated there are solely two potential explanations for why 1,300 cell numbers had been linked with 62,000 financial institution accounts: data-entry errors or inside fraud.

Parulkar, who has been within the banking and consulting sector for twenty years, added: “There can’t be a situation the place you’ve one cell quantity linked with 30-odd accounts or so many accounts. Hardly ever can or not it’s justified as an oversight.”

He stated that if the allegation of app registrations from the again finish is true, this can be a case of gross misconduct on the a part of the financial institution. He identified that including bogus cell numbers to financial institution accounts has safety implications, together with info safety compromise, privateness issues and fraud.

“It is going to compromise the account holder’s cash at some stage in time. Cash can vanish,” he stated.

Al Jazeera discovered tweets from Financial institution of Baroda clients alleging that cash despatched to them by way of their cell number-linked checking account ended up in another person’s checking account since their telephone quantity was apparently registered with a number of accounts. Whereas one wrote he misplaced 25,000 rupees ($302) on this method, one other wrote she has misplaced 2,500 rupees ($30), 1,500 rupees ($18) and extra over a yr.

Aggressive enrolment targets

Because the Indian authorities intensely promotes digital banking and pushes for the transition in the direction of a less-cash financial system, the scandal casts a shadow on the security of consumers’ cash and spotlights the ham-handed approach through which banks deal with delicate monetary info. Parulkar concurred that the push to extend numbers – on this case, app registrations – by any means potential would indicate the shortage of inside controls, common monitoring and reporting mechanisms to detect and forestall unfair enterprise practices.

Whistleblower 1’s department itself has undergone the obligatory, periodic auditing of a spread of financial institution actions, reminiscent of record-keeping, adherence to guidelines and laws, and protected banking practices. However the inside auditors apparently didn’t flag the unethical course of regardless of it being their accountability to crosscheck clients’ consent types.

Situations of banks utilizing illegal strategies to pad numbers have been on the rise, breaking fiduciary belief. Beforehand, an investigation by The Reporters’ Collective revealed how banks throughout India had been charging clients for the federal authorities’s a number of insurance coverage and pension schemes they didn’t want or hadn’t requested. They enrolled clients within the insurance coverage and pension schemes straight from the again finish or by acquiring consent signatures by means of mis-selling, schemes for which these account holders are nonetheless paying.

Relating to bob World registrations, Bhopal and Baroda zones (the place large-scale malpractices have been alleged by Whistleblower 1 and the retired govt, respectively) had been cited because the benchmark by different zonal workplaces to their regional managers.

The Financial institution of Baroda launched bob World in September 2021 as part of its formidable push to go digital. The financial institution claims the app now has 5 million customers. In 2021, the Financial institution of Baroda was recognised because the Finest Expertise Financial institution on the Indian Banks’ Affiliation Banking Expertise Awards. Additionally, within the final two editions of Enterprise As we speak-KPMG Finest Banks Awards, it was named the Finest Financial institution in Fintech Initiative.

However aggressive enrolment targets spurred dangerous behaviour. Inside chatter about what allegedly transpired in the course of the March 24 sign-up marketing campaign spilled out on social media the subsequent day, and financial institution staff brazenly referred to as out the financial institution’s administration (here, here and here). The outrage died in Twitter’s echo chamber of some financial institution staff and was not reported within the media. Whistleblower 1 stated his regional workplace stopped harassing branches for bob World enrolment thereafter, however he heard from a colleague within the financial institution’s department in rural Uttar Pradesh later final yr that they nonetheless confronted stress for bob World sign-ups and had been resorting to misleading options.

Imposing app on the poor

A number of Financial institution of Baroda staff from totally different branches advised Al Jazeera about one other workaround they discovered to spice up app registrations: focusing on the working-class clients who had been nonetheless utilizing characteristic telephones and wouldn’t be capable of obtain the financial institution app. Financial institution staff took the SIM card of such customers and inserted it within the department’s official pill or an worker’s smartphone, with their permission, to signal them up. The officers stated they might name such clients to the department and signal them up individually like this.

@nsitharaman @RBI large fraud ready to occur in BOB.Buyer hving quantity pad bsc cell,their Sim is removd and installd in financial institution smartphone to activate #bobworld.If sm wrng transaction happn in cust. a/c will @bankofbaroda HO tk respnsiblity or RBI @officialAIBOC @CNBCTV18News

– Nikhil Kansal (@NikhilK45879940) March 28, 2022

Whistleblower 2, who oversaw the enrolment marketing campaign at a department final yr, stated concepts for such shortcuts got here from the zonal workplace and the top workplace. He stated the upper workplaces would study such techniques from the branches that had been handing over good numbers, and advise nodal officers to emulate these. He stated regional workplaces would even ship branches lists of consumers of the identical household and with the identical registered cell quantity, in order that by convincing one such buyer, a cell quantity might be registered and deregistered on the app a number of instances.

Requesting anonymity attributable to fears of reprisal, an worker of a rural department in Bhopal zone advised Al Jazeera that he received such a listing from his regional workplace for final yr’s March 24 enrolment marketing campaign. Al Jazeera has a replica of the e-mail and the record. The worker would name up the villagers, request that they arrive to the department after which register all of the account holders of their household on bob World. Upon his insistence, just a few villagers got here in as late as 9pm, although begrudgingly.

![An internal email from the bank's Bhopal zone notes that branches were kept open till 10 pm to facilitate bob World registrations.[Screen grab]](https://www.aljazeera.com/wp-content/uploads/2023/07/Image-3-1688627087.jpg?w=770&resize=770%2C514)

An officer from Rajasthan, requesting anonymity, described one other gimmick to Al Jazeera. He stated his department launched a marketing campaign to open zero-balance accounts to draw unskilled labourers and each day wagers, signing up all of them on bob World with out consent. He stated the workers did inform the labourers that the app is linked to their cash and readily uninstalled it for individuals who had been cautious.

The officer famous the irony of enabling digital banking for individuals who barely make ends meet.

“On the finish of the day, to satisfy the quantity [target] and save your bread and butter, you must do such issues.”

Failing to get the job completed in such campaigns places staff on the threat of disciplinary motion and abusive tirades from seniors.

‘Controls in place’

Since Financial institution of Baroda’s inside emails ask branches to suggest financial institution accounts from which bogus cell numbers should be unlinked, Al Jazeera, underneath India’s Proper to Data regulation, requested the financial institution what number of branches despatched suggestions for a similar and what number of accounts had been advisable in 2022.

Al Jazeera additionally sought a replica of each e-mail, letter, and round despatched to branches and/or zonal workplaces relating to the deletion of duplicate cell numbers. The financial institution replied that it doesn’t keep such information although a whistleblower’s regional workplace’s emails to branches state that “the method of elimination/correction of cell quantity is to be carried out centrally from the again”.

Moreover, Al Jazeera requested the Financial institution of Baroda for a month-wise record of the variety of customers becoming a member of bob World and quitting the app. The financial institution declined, saying that it’s a commerce secret and is exempted from disclosure.

In response to Al Jazeera’s questions, a spokesperson for the financial institution stated in an e-mail: “The financial institution has a strong system with the required controls in place. The bob World cell banking app can’t be linked to the identical cell quantity greater than as soon as. Additional, to register or replace a cell quantity in a checking account, clients want to go to the financial institution department in individual and observe a two-factor authentication course of, publish which the cell quantity is activated after 24 hours.

“With regard to your query on the linking of financial institution accounts to 1 cell quantity, the financial institution has restricted the seeding of 1 cell quantity to eight buyer IDs, supplied that the registered [postal] handle is similar. This facility presents comfort to clients belonging to the identical household.”

The financial institution didn’t deny the authenticity of the emails Whistleblower 1 has shared, and didn’t reply how so many accounts received linked with the identical cell numbers regardless of a restriction on what number of accounts a telephone quantity might be linked to.

Whistleblower 1 expressed deep disappointment at being drawn into this. “I used to be so crestfallen for this,” he stated. “I’m sitting until 10pm within the workplace, and an individual is coming from the regional workplace to make us do that … Is that this a financial institution or one thing else?”

Hemant Gairola is an affiliate member of The Reporters’ Collective.

[ad_2]

Source link